WestRock Mill Closure

To our members affected by the WestRock mill closure, please reach out to us at 850.233.4400.

Innovations is here and ready to assist you with your financial concerns.

It's the end of an era!

Join us in extending our most heartfelt congratulations to Karen Hurst, Senior Vice President / Chief Marketing Officer, on her retirement.

We’re thankful for her leadership and dedication to Innovations for the past 17 years.

Congratulations on your retirement, Karen!

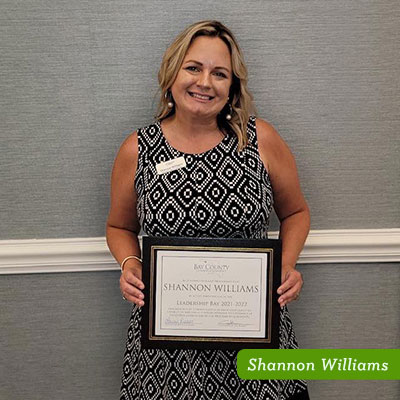

Congratulations, Shannon Williams!

Shannon Williams, Lynn Haven Branch Manager, recently graduated from the 2021-2022 Leadership Bay Program. This prestigious program, hosted by the Bay County Chamber of Commerce, is an extensive professional and personal commitment. The end result is an increased level of knowledge and leadership skills that will serve Shannon (and Innovations) well into the future.

Thank you for your dedication, Shannon!

Congratulations to our Certified Financial Counselors

Shannon Williams recently earned the Certified Credit Union Financial Counselor (CCUFC) designation from the Credit Union National Association (CUNA).

Shannon Williams recently earned the Certified Credit Union Financial Counselor (CCUFC) designation from the Credit Union National Association (CUNA).

Kasey Phillips recently earned the Certified Credit Union Financial Counselor (CCUFC) designation from the Credit Union National Association (CUNA).

Kasey Phillips recently earned the Certified Credit Union Financial Counselor (CCUFC) designation from the Credit Union National Association (CUNA).

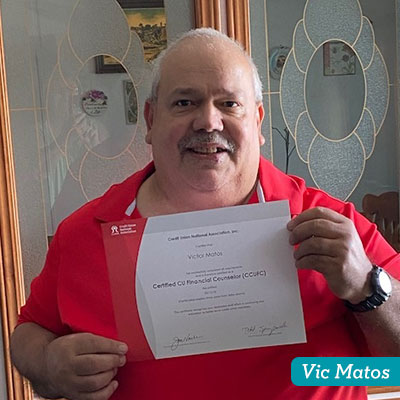

Vic Matos renewed his CCUFC designation through the CUNA Financial Counseling Certification Program (FiCEP).

Vic Matos renewed his CCUFC designation through the CUNA Financial Counseling Certification Program (FiCEP).

FiCEP provides credit union employees with the skills and knowledge needed to assist credit union members by making smart financial decisions. Shannon, Kasey and Vic are now highly trained to help you in a variety of areas, such as credit card management; navigating medical debt; financing higher education; avoiding identity theft and more.

Need expert financial advice? Let Shannon, Kasey, Vic or any of our certified financial counselors help you spark change.

NCBSO designation—it’s a big deal

Kasey Phillips, Recovery Officer, and Kurt Kormann, Compliance Officer, earned the Certified Bank Secrecy Officer (NCBSO) designation from the National Association of Federally-Insured Credit Unions (NAFCU).

Kasey and Kurt now comprehensively understand Bank Secrecy Act (BSA) methodology and money laundering threats. The Bank Secrecy Act (BSA) is a U.S. law requiring financial institutions in the United States to assist U.S. government agencies in detecting and preventing money laundering. This is beneficial in protecting the public from cybercrime, fraud and other illegal financial security threats.

Keeping our members and your money safe from financial fraud is a key focus at Innovations. Congratulations to Kasey and Kurt for their commitment to Innovations and our members.

The results are in

Our 70th Annual Meeting was held virtually on March 22nd. Congratulations to the following members of the Board of Directors re-elected for another term:

- Rob Fernandez - Chairman

- Kristopher McLane - Treasurer

- Anita Broughton - Director

- Nancy Luther - Director

Many thanks to all the Board of Directors and Supervisory Committee for their continued commitment to Innovations. Meet the Innovations Board of Directors and Supervisory Committee.

Congratulations to our second group of Innovations TMA™ graduates!

The Member Advantage™ (TMA) training helps managers and team members understand the importance of consistently providing member-focused service. Congratulations to the Innovations team members who completed the training!

New Bill Pay Features: Improving your Online Banking & Mobile Banking experience

If you’ve tried our Bill Pay service already, you know what a time-saver it is. If you haven’t, check it out to see the two new features we’ve added to provide you with more flexibility and convenience.

The Person to Person (P2P) feature allows members to send money to anyone using their cell phone number or email address. Recipients can take up to 10 days to accept the funds, and you can send a maximum of $500 per day.

eBill centralizes the management of all your bill payees. It’s a one-stop shop for payment history, statements and bill details, such as due dates, balances, account statuses and notification reminders to ensure timely payments.

Take a look at everything Bill Pay offers.

Extra wiggle room when you roam

One of the easiest ways to get more bang for your budget is to start with a low-payment vehicle loan from Innovations. Auto, ATV, boat or recreational vehicle—our low-rate loans are a great way to make ends meet more easily on new purchases or by refinancing a higher-rate loan from another lender. And, of course, we’re local.

Ready to get more bang for your budget? Apply today.

Our VISA® Credit Cards are a knockout

When you need palm-sized power with unlimited potential, you need our Platinum VISA® Credit Card. It packs a big punch with features like low rates, no annual fees and no balance transfer fees. Looking for something that earns points on every purchase? Try our PlatinumEdge VISA® Awards Card. It offers the same great features, and the Extra Awards® points can be used toward gift certificates and travel-related vouchers.

Need more power in your palm? Apply today.

Ignite Checking is ready to roll

Spring is “go” time, and our Ignite Rewards Checking is the only one around that provides you with the fuel you need to keep up the pace. It’s not only free, but there’s also no minimum deposit to get started, no minimum balance to earn rewards, no monthly service fees, with free Online and Mobile Banking and Bill Pay. You can also earn up to $8 in cash back per cycle* and up to $15 in ATM refunds per cycle* if you need to use an ATM machine that’s outside our network.

Spring forward with Ignite Rewards Checking.

*To qualify, you must enroll in and receive eStatements and clear at least 15 debit card transactions per cycle. For any cycle in which you do not qualify, there are no penalties, but you will forfeit cash back and ATM refunds.

Holiday Closings

Innovations will be closed in observance of the following holidays:

- Memorial Day: Monday, May 30, 2022

- Juneteenth: Monday, June 20, 2022 (observed)*

- Independence Day: Monday, July 4, 2022

Click here to see all of our scheduled holiday closings.

*Juneteenth falls on Sunday. The Federal Reserve Board of Governors is closed on June 20, 2022 in recognition of Juneteenth.

|

|||||||||||||||||||